America’s Real Estate: Industrial Logistics Panel Recap

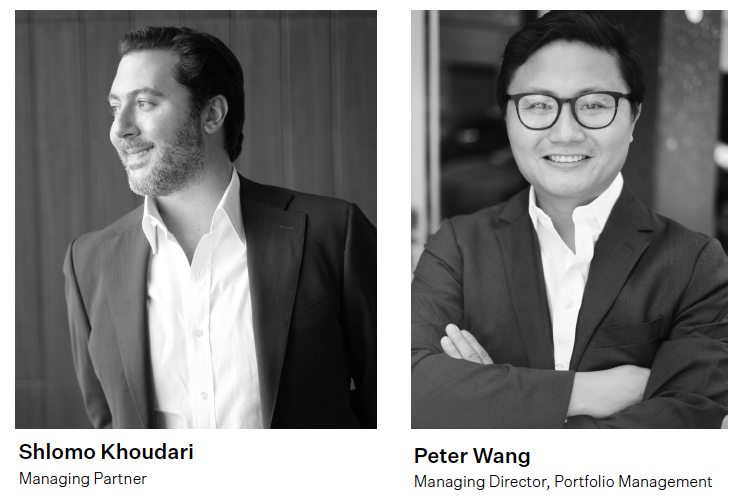

On July 12, 2023, Elion’s Managing Partner, Shlomo Khoudari, and Managing Director of Portfolio Management, Peter Wang, discussed the normalization of industrial logistics real estate post-COVID-19 pandemic in a group meeting hosted by Goldman Sachs’ Equity Research team.

Below are Elion’s key takeaways from the discussion.

Demand is Normalizing but Still Strong

Elion believes the current supply/demand dynamics in core, coastal markets continue to favor the landlord. As demand normalizes (i.e., trends back to 2019), Elion believes rental rate increases will be driven by supply (or lack of supply), resulting in more substantial pricing power for last-mile warehouses.

Potential for Market Performance Divergence

After three years of unprecedented industrial real estate performance, the US industrial market is beginning to normalize to pre-pandemic activity. Elion anticipates more divergence in future market performance as demand returns to 2019 levels, with large spaces in the middle of the country being most at risk. Elion believes select primary markets may have a high chance of correction due to softening demand and incoming supply, with incoming supply at 1.5x the prior year’s absorption. In contrast, Elion’s target markets are 0.5x the preceding year’s absorption. With higher interest rates and stringent financing conditions, Elion believes market selection will be key.

Sustained Rent Growth Expected in Supply-Constrained Markets

Elion discussed that highly dynamic markets, supported by high-volume ports, e-commerce growth, and supply chain efficiency, should sustain rent growth well into the future. On a risk-adjusted return basis, Elion believes the supply-constrained nature and lengthy entitlement process seen in select core, coastal markets should sustain outperformance compared to other markets.

A Period of Price Discovery

Elion believes industrial acquisitions are currently in a period of price discovery and that transaction activity should escalate in the fourth quarter of 2023 and the first quarter of 2024, assuming no macroeconomic surprises. Elion added, there is still a large amount of non-institutionally-owned industrial warehouses in its markets, where it believes motivated sellers (such as developers with higher-than-anticipated construction and financing costs, or owner/users facing financing challenges with debt maturities, and corporations in need of cash via a sale-leaseback) will emerge.

About Elion

Elion is a vertically integrated investment manager specializing in the industrial logistics real estate sector. With a strong focus on data-informed strategies and a diverse team with cycle-tested industrial domain knowledge, the firm manages $3.4 billion in gross real estate assets (as of March 31, 2023).